south san francisco sales tax rate 2021

The minimum combined 2021 sales tax rate for south san francisco california is. The minimum combined 2022 sales tax rate for South San Francisco California is.

Finance Department City Of South San Francisco

A yes vote was a vote in favor of increasing the local hotel tax incrementally from 10 percent to 14 percent in 2021 with funds used for general city.

. The South San Francisco California sales tax is 750 the same as the California state sales tax. 1788 rows California City County Sales Use Tax Rates effective April 1. Click here to find other recent sales tax rate changes in California.

The San Francisco Tourism Improvement District sales tax has been changed within the last year. While many other states allow counties and other localities to collect a local option sales tax. The December 2020 total local sales tax rate was 8500.

The California sales tax rate is. 2021 State Sales Tax Rates California has the highest state-level sales tax rate at 725 percent. By wilson walker july 1 2021 at 701 pm.

This is the total of state county and city sales tax rates. As we all know there are different sales tax rates from state to city to your area and everything combined is the required. The sales and use tax is rising across california including in san francisco county.

Method to calculate South San Francisco sales tax in 2021. This is the total of state and county sales tax. The County sales tax rate is.

It was raised 0125 from 975 to 9875 in July 2021. Sales Use Tax Rates. The phone number for general tax questions is 1-800-400-7115.

Did South Dakota v. Property taxes are collected by the County Tax Collector for the City and various other taxes are collected by the State and. 1788 rows san francisco 8625.

It was raised 0125 from 975 to 9875 in July 2021. The Sales and Use tax is rising across California including in San Francisco County. The South San Francisco sales tax rate is.

What is the sales tax rate in South San Francisco California. In San Francisco the tax rate will rise from 85 to 8625. The minimum combined 2022 sales tax rate for San Francisco County California is 863.

Method to calculate Simi Valley sales tax in 2021. What is the sales tax rate in San Francisco County. 2021 local sales tax rates.

Go to our website at. Santa Clara County This rate applies in all. South San Francisco Sales Tax Rate 2021.

City of South San Francisco. The South San Francisco sales tax has been changed within the last year. The California sales tax rate is currently.

4 rows The current total local sales tax rate in South San Francisco CA is 9875. It was raised 0125 from 85 to 8625 in July 2021 raised 0125 from 85 to 8625 in. How much is sales tax in San Francisco.

Most of these tax changes were. The minimum combined sales tax rate for San Francisco California is 85. Those district tax rates range from 010 to 100What is the sales tax in California 20217252021 Local Sales Tax RatesA Presidio San Francisco Sales Tax.

How much is sales tax in San Francisco. 850 Is this data incorrect The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales. This is the total of state county and city sales tax rates.

As we all know there are different sales tax rates from state to city to your area and everything combined is the. Wwwcdtfacagov and select Tax and Fee Rates.

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

States With Highest And Lowest Sales Tax Rates

California Sales Tax Small Business Guide Truic

Why Households Need 300 000 To Live A Middle Class Lifestyle

Frequently Asked Questions City Of Redwood City

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Sales Gas Taxes Increasing In The Bay Area And California

Understanding California S Sales Tax

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Understanding California S Sales Tax

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Sales Tax On Saas A Checklist State By State Guide For Startups

California Sales Tax Rates By City County 2022

Sales Tax On Grocery Items Taxjar

Transfer Tax In San Mateo County California Who Pays What

California City County Sales Use Tax Rates

Secured Property Taxes Treasurer Tax Collector

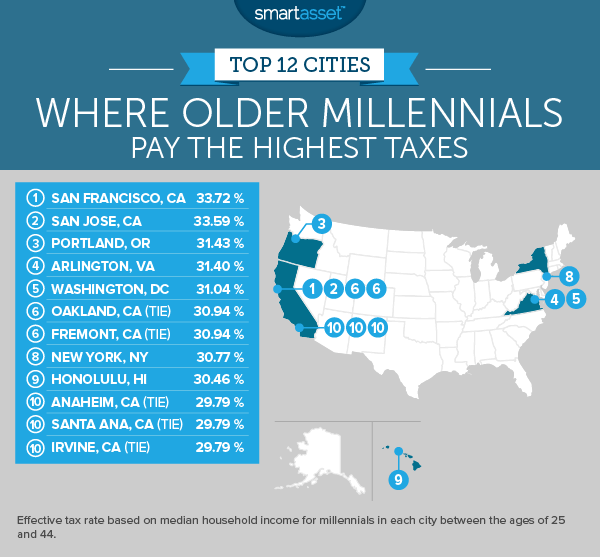

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset